All salaried employees working in the private, public or government sector organizations will be familiar with EPF or PF. Employee Provident Fund or Provident Fund is a retirement scheme introduced by the EPFO to help salaried employees create a retirement corpus. Every organization which has over 20 employees has to compulsorily register with the EPFO in order for its employees to benefit from the EPF scheme.

Every time an employee joins a new organization or switches their job, a new PF account is created for them. As for the previous account help with their previous organization, they have the option of either transferring the balance to the newly opened PF account or withdrawing the balance. However, often, employees sometimes prefer to withdraw their PF account balance every time they switch their job, quoting reasons such as default in PF payments on the part of their employer. Doing this, more or less, defeats the purpose of a PF account itself.

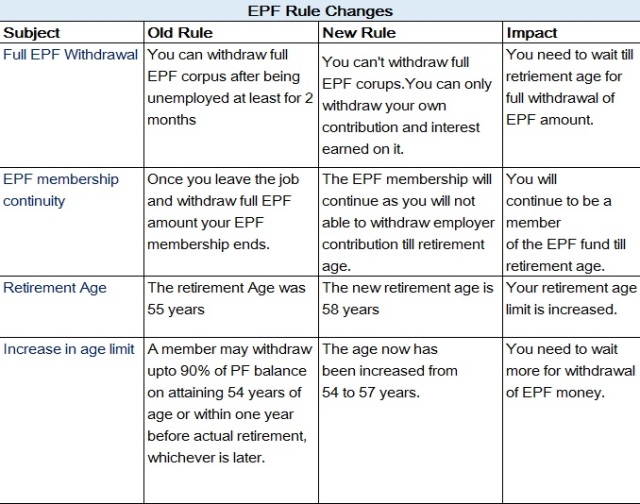

When it comes to PF account balance, experts have always sided with the view that one must try to avoid withdrawing their PF account balance before reaching retirement or break into their PF fund only if it is a dire emergency. Currently, the regulations governing PF account balances allow account holders to either transfer their account balance to their new employer or withdraw the amount. Considering the hassle involved in the transfer of an EPF account from one employee to another and keeping track of multiple EPF accounts opened by an individual during their employment, EPFO has introduced an arrangement of having a single EPF account.

Withdrawing from an EPF account is accompanied by several disadvantages, the biggest of which is that it completely defeats the purpose of having an EPF account. The other advantages which one foregoes include tax related concessions which come with EPF. When a salaried individual who is an EPFO member withdraws their EPF balance after a term of 5 years of uninterrupted employment, the balance and interest does not attract any interest. On the other hand, if the employee withdraws their EPF account balance before the term of 5 years of continuous service, their EPF balance i.e. the employer’s contribution towards the EPF and the interest earned on the contribution will be taxable as a part of the head salary income.

The one thing that can be considered important by EPF account holders in terms of withdrawal and related taxation is that if an account holder must withdraw funds from their EPF account for requirements that are out of the employee’s control, despite the fact that the employee has not had a continuous employment term of 5 years, the withdrawal will not be taxable.

As for those who are nearing retirement, if an employee has had the same PF number during the entire course of their employment, they will be eligible for receiving a pension after they have crossed 58 years of age. This facility of a receiving pension is available not only to private sector employees but also to government sector employees, provided that the employee has not withdrawn the funds from their EPF account during their entire employment period. The pension which is given to a member for keeping an intact EPF account, as per the Employee Pension Scheme, is equal to 8.33%, from the 12%, that is the employer’s contribution.

Considering the aforementioned points, it is quite clear that EPF withdrawals at the time of switching a job can only bring disadvantages. Only if you really are in dire need of cash and your EPF account if your only solution, must you withdraw those funds. Otherwise, do try to avoid withdrawing those funds before you finish 5 years of uninterrupted employment.